Loading

Get Photo Of Eic Form 1040

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Photo Of Eic Form 1040 online

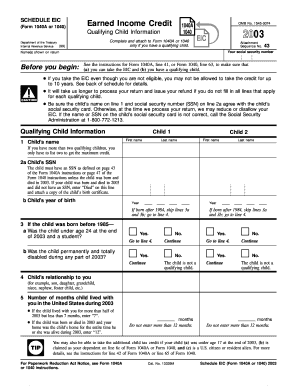

Filling out the Photo Of Eic Form 1040 online is a straightforward process designed to help users claim the Earned Income Credit (EIC) for qualifying children. This guide provides step-by-step assistance to ensure that you complete the form accurately and efficiently.

Follow the steps to fill out the Photo Of Eic Form 1040 online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the eligibility criteria for claiming the Earned Income Credit, including ensuring you have a qualifying child.

- Enter your social security number at the top of the form and the names as they appear on your tax return.

- In the Qualifying Child Information section, fill in the child's name and social security number, making sure they match the child's social security card.

- Provide the child's year of birth and indicate if the child was permanently and totally disabled during the relevant year.

- Specify the child's relationship to you, such as son, daughter, or foster child.

- Indicate the number of months the child lived with you in the United States during the tax year, using appropriate values.

- If applicable, review the additional child tax credit requirements and complete any related information.

- Once all information is filled in, save your changes, and choose to download, print, or share the completed form as necessary.

Prepare and complete your Photo Of Eic Form 1040 online today!

Related links form

Figuring out your EIC involves assessing your earned income, filing status, and number of qualifying children if any. The IRS provides a calculator on their website to help you determine your credit. Additionally, accessing a Photo Of Eic Form 1040 can help clarify where to input your information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.