Loading

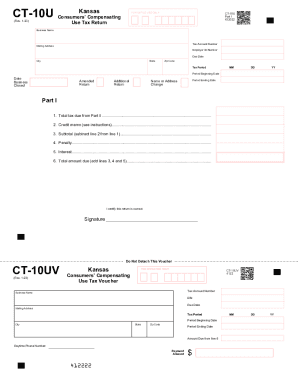

Get Ct-10u Consumers Compensating Use Tax Returns And Instructions Rev. 1-23

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT-10U Consumers Compensating Use Tax Returns And Instructions Rev. 1-23 online

Filling out the CT-10U Consumers Compensating Use Tax Return can seem daunting, but with a clear step-by-step approach, you can efficiently complete this essential tax form online. This guide provides you with the necessary instructions to ensure your submission is accurate and timely.

Follow the steps to successfully complete your CT-10U form.

- Click ‘Get Form’ button to access the CT-10U form and launch it in the online editing interface.

- Begin by completing Part II of the form before addressing Part I. This section requires you to report specific jurisdictional tax details.

- In Part II, for each taxing jurisdiction, enter the required information: the name of the city or county, the total amount of taxable purchases, and the appropriate tax rate.

- In Part II, use the columns to calculate the net tax for each jurisdiction by multiplying the taxable amount by the tax rate specified.

- If applicable, mark the 'Tax on Food' checkbox if you are reporting compensating use tax on eligible food or food ingredients.

- Complete Part I by transferring totals from Part II. Enter the total tax due from Part II on line 1 and any credits or penalties in the following lines.

- Ensure that you add lines calculated in Part I correctly, maintaining the structure to reach the final total due.

- Once all sections are accurately filled out, use the options available to save your changes, download, print, or share the completed form.

Complete your CT-10U Consumers Compensating Use Tax Return online today for a quicker and more efficient filing process.

Since 1937 Kansas imposed a compensating use tax on goods purchased from outside Kansas and used, stored or consumed in Kansas. Its purpose is to protect Kansas retailers from unfair competition from out-of-state retailers who sell goods tax-free by applying a tax on these items equal to the Kansas rate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.