Loading

Get St-28f Agricultural Exemption Certificate Rev. 8-22. Farmers, Ranchers, Feedlots, Fisheries, Grass

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ST-28F Agricultural Exemption Certificate Rev. 8-22 online

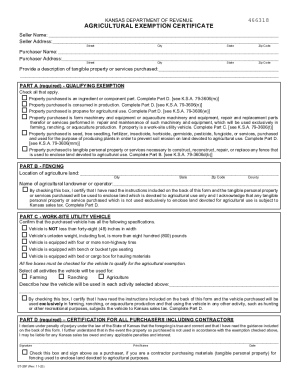

The ST-28F Agricultural Exemption Certificate is essential for farmers, ranchers, feedlots, fisheries, and grass producers to claim tax exemptions on certain purchases. This guide provides clear instructions for filling out the form accurately and efficiently.

Follow the steps to complete the ST-28F Agricultural Exemption Certificate.

- Click 'Get Form' button to access the form and open it for editing.

- Complete the seller's name and address sections by providing the full name, street address, city, state, and zip code.

- Fill in the purchaser's name and address just as you did for the seller. Ensure all information is accurately provided.

- Describe the tangible property or services purchased in detail, specifying the nature of the items being acquired.

- In Part A, check all applicable boxes that describe the qualifying exemptions. Each exemption type has specific conditions, so ensure you review each one carefully.

- If you checked any box in Part A that requires further information, complete either Part B (Fencing) or Part C (Work-Site Utility Vehicle) as applicable. Provide necessary details such as the location of agricultural land or vehicle specifications.

- In Part D, read the certification statement carefully. By signing, you confirm the truthfulness of the information and acknowledge the potential tax liability if misused.

- Sign and print your name in the designated areas, and include the date of completion.

- After completing the form, save your changes. You can download, print, or share the completed form as needed.

Ensure your tax exemptions are maximized by correctly completing your ST-28F Agricultural Exemption Certificate online.

California, like every other state, offers property tax breaks for agricultural land. Specifically, farmers are able to take 20 to 75 percent off their property tax bill if they agree not to develop their land for ten years and do so with at least 100 acres.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.