Loading

Get How To Fill Form F843

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To Fill Form F843 online

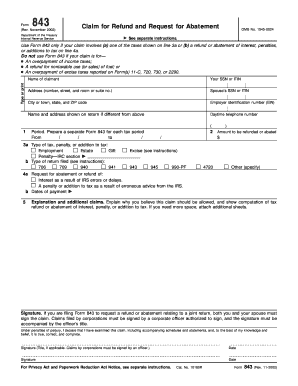

Filling out the How To Fill Form F843 is crucial for users seeking a refund or abatement regarding specific tax issues. This guide provides step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to successfully complete your Form F843 online.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Enter your social security number (SSN) or individual taxpayer identification number (ITIN) in the designated field.

- Provide your complete address, including number, street, and room or suite number, along with your city, state, and ZIP code.

- If applicable, input your spouse's SSN or ITIN in the appropriate section.

- Fill in your employer identification number (EIN) if relevant, and specify the name and address as shown on your tax return if it differs from the above.

- Indicate the tax period for which you are filing the claim by filling out the period section with the start and end dates.

- Identify the type of tax, penalty, or addition to tax by selecting the appropriate option from the given categories.

- State the amount you wish to be refunded or abated in the designated field.

- In the request for abatement or refund section, specify whether it relates to interest or a penalty and provide the dates of payment if relevant.

- Provide a detailed explanation and computation for your claim in the explanation section, ensuring clarity and completeness.

- Sign the form as required. If filing jointly, both parties must sign. If your filing pertains to a corporation, ensure it is signed by an authorized officer.

- Review your entries thoroughly for accuracy before saving any changes to the form. You may then download, print, or share it as needed.

Complete your Form F843 online today for a smoother filing experience.

To complete Form 843, start by providing your personal information in the designated sections. Next, clearly state the reason for your request, ensuring you include any relevant details that support your case. Take your time to review your entries for accuracy, as knowing how to fill Form F843 can significantly influence the outcome of your submission.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.