Loading

Get Tc-90cb Renter Refun Application (circuit Breaker Application). Forms & Publications

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TC-90CB Renter Refund Application (Circuit Breaker Application) online

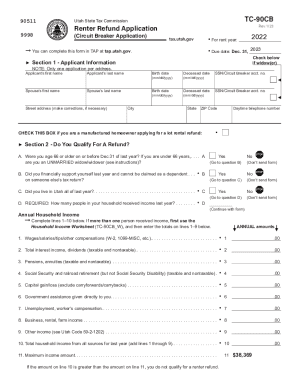

The TC-90CB Renter Refund Application is designed to assist eligible individuals in Utah in obtaining a refund for rent paid during the previous year. This guide provides step-by-step instructions on how to accurately complete the application online, ensuring that you meet all necessary requirements.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to access the TC-90CB Renter Refund Application and open it in the editor.

- Complete Section 1 - Applicant Information. Provide your first name, last name, and your spouse's name if applicable. Include the street address, city, state, ZIP code, birth dates, and Social Security Number or Circuit Breaker account number. Ensure that all fields are completed accurately.

- Move to Section 2 - Do You Qualify For A Refund? Answer each question (A to D) carefully. Provide details about your household income by completing lines 1 through 10 as instructed, using annual amounts only.

- Fill out Section 3 - Last Year’s Rent Information. For each address where you rented last year, list the rental address, landlord's name and phone number, the number of months you lived there, and the total rent paid for that year.

- Complete Section 4 - Residency Status, Certification, and Signature. Indicate your residency status by checking the appropriate box. Sign the application and provide the necessary information regarding the preparer if applicable.

- Review your completed application for accuracy. Ensure that you have filled out all required sections and that all information is consistent.

- Save your changes, and download the application. You may also choose to print or share the completed document.

Take the next step towards your refund by completing the TC-90CB Renter Refund Application online today.

The Circuit Breaker tax relief program assists eligible elderly homeowners by reducing property taxes on their primary residence. Those eligible may obtain: A reduction or abatement of property taxes on a principal residence equivalent to a 20% reduction in fair market value of your property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.