Loading

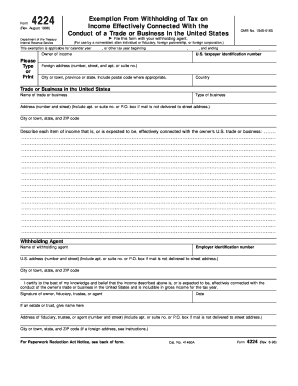

Get Form 4224 Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4224 Irs online

Filling out the Form 4224 Irs online can streamline the process of obtaining an exemption from withholding tax on income associated with a trade or business conducted in the United States. This guide provides detailed, user-friendly instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the Form 4224 Irs online.

- Press the ‘Get Form’ button to access the form and open it in your editor.

- Fill in the details for each section. Begin by entering the calendar year for which the exemption applies, as well as the start and end dates of the tax year. Clearly write the owner's name associated with the income, ensuring accuracy.

- Provide the U.S. taxpayer identification number. If the owner does not have a social security number (SSN), ensure they apply for an IRS individual taxpayer identification number (ITIN).

- Fill in the foreign address of the income owner, including the number, street, apartment or suite number, city, province or state, and country. Be sure to include the postal code where appropriate.

- Identify the trade or business conducted in the United States by entering the name and type of business. Include a detailed address where the business is located.

- List and describe each item of income that is connected with the owner's U.S. trade or business. Ensure all expected income items are mentioned.

- Enter the withholding agent’s name and employer identification number (EIN), along with their U.S. address. Make sure to gather the withholding agent's EIN before submitting the form.

- Sign and date the form in the designated area. If the signer is a fiduciary or trustee, include their name and address.

- Review all filled sections for accuracy and completeness. Once the form is accurate, users can save changes, download, print, or share the completed form as needed.

Complete the Form 4224 Irs online today to streamline your exemption process.

Related links form

Using Form 7202 involves filling out details about your eligibility for sick leave and family leave credits. You need to provide accurate information to benefit from the tax credits. If you're unsure about the specifics, uslegalforms has resources to assist you in completing this form correctly and ensuring you receive the benefits you deserve.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.