Get 2022 Form 3805v Net Operating Loss (nol) Computation And Nol And Disaster Loss Limitations

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2022 Form 3805V Net Operating Loss (NOL) Computation And NOL And Disaster Loss Limitations online

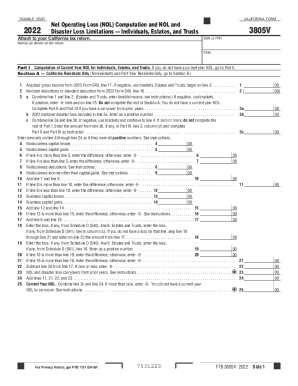

The 2022 Form 3805V is essential for individuals, estates, and trusts to compute their net operating loss (NOL) in California. This guide provides clear instructions for each section and field of the form to assist users in filling it out accurately and comprehensively online.

Follow the steps to effectively complete your NOL computation form.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- In Part I, Section A, for California residents, enter your adjusted gross income from line 17 of your 2022 Form 540. If this amount is negative, indicate it using brackets.

- For line 3b, if you have a 2022 declared disaster loss, enter this amount as a positive number.

- Continue entering amounts from lines 4 to 24, treating all amounts as positive numbers, following the provided instructions in each section.

- Calculate your Current Year NOL by combining line 3c with line 24, entering the result on line 25. If this amount is more than zero, enter -0-.

- If you are a nonresident or part-year resident, complete Section B similar to Part I, starting with your adjusted gross income and following the same steps outlined above.

- Move to Part II to determine your modified taxable income (MTI), entering amounts as instructed. Finally, use Part III to document NOL carryover and disaster loss carryover limitations, ensuring you follow each column carefully.

- Once all fields are completed, review for accuracy, save your changes, and prepare to print, download, or share the form as needed.

Complete your documents online now to ensure timely and accurate filing.

Net Operating Loss (NOL) Carryforward Example The full loss from the first year can be carried forward on the balance sheet to the second year as a deferred tax asset. The loss, limited to 80% of income in the second year, can then be used in the second year as an expense on the income statement. Net Operating Loss (NOL): Definition and Carryforward Rules Investopedia https://.investopedia.com › ... › Accounting Investopedia https://.investopedia.com › ... › Accounting

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.