Loading

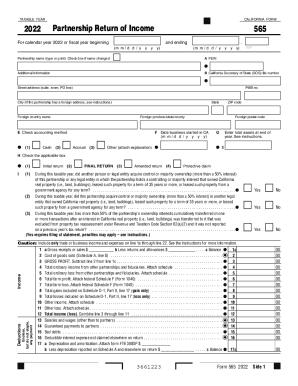

Get 2022 California Form 565 Partnership Return Of Income. 2022, California Form 565, Partnership

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2022 California Form 565 Partnership Return Of Income online

Filing the 2022 California Form 565 Partnership Return Of Income is an essential process for partnerships operating in California. This guide will provide you with step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the respective editor.

- Enter the partnership name in the designated field. If there has been a name change, check the appropriate box.

- Fill in the partnership's Federal Employer Identification Number (FEIN) and California Secretary of State file number.

- Provide the street address, city, state, and ZIP code for the partnership. If the partnership has a foreign address, complete the foreign country name and any applicable extra information.

- Select the accounting method (Cash or Accrual) and specify whether this is the initial return, final return, amended return, or protective claim.

- Indicate the total assets at the end of the year by entering the appropriate dollar amount.

- Answer the questions regarding control or majority ownership involving California real property by selecting 'Yes' or 'No' as applicable.

- Report income in the designated income section, including gross receipts, cost of goods sold, and any additional income. Include only trade or business income and expenses.

- Fill out the deductions section, including salaries, guaranteed payments, bad debts, and any other applicable deductions.

- Calculate the total income or loss by combining the relevant lines. Proceed to the payments section, detailing fees, amounts due or refunds.

- Complete the entity type and principal business activity code, ensuring all information is accurate. Specify the maximum number of partners and any relationships among them.

- Review the signing section where the general partner must sign and provide their contact information. If a paid preparer assisted, ensure their information is also filled out.

- Once all fields are completed, save the changes, and choose the option to download, print, or share the form.

Start completing your documents online now for a smoother filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Form 565 is used by LLCs classified as corporations for federal tax purposes, whereas Form 568 is for LLCs classified as partnerships or disregarded entities. Determining your LLC's federal tax classification is essential to determine which form to use.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.