Loading

Get Irs Forms To Print

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Forms To Print online

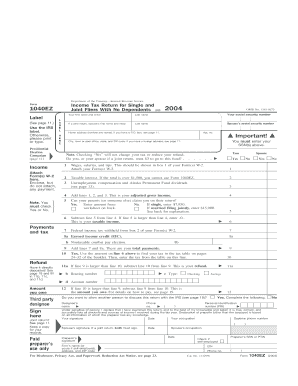

Filing your taxes can be a straightforward process with the right guidance. This guide will help you navigate the steps needed to accurately fill out the IRS Forms To Print online, ensuring you have all the necessary information to complete your tax return with confidence.

Follow the steps to complete the IRS Forms To Print online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your first name and initial in the designated fields. If filing jointly, include your spouse's first name and initial as well. Ensure this section is free of errors, as it is crucial for identification.

- Enter your Social Security Number (SSN) in the provided field. If filing jointly, also input your spouse's SSN. It is important to check this information for accuracy.

- Fill in your home address accurately, including the number and street, apartment number if applicable, city, state, and ZIP code. Double-check for typos to prevent any mailing issues.

- Indicate if you or your spouse wish to allocate $3 to the Presidential Election Campaign by selecting 'Yes' or 'No'. This selection will not affect your tax refund.

- Provide information regarding unemployment compensation and Alaska Permanent Fund dividends if applicable. Sum these amounts as instructed.

- Report your taxable interest and any additional income as required, ensuring that you total these values as specified. Note that if your taxable interest exceeds $1,500, you cannot use this form.

- Calculate your adjusted gross income by adding your reported income sources. Follow the instructions carefully to ensure correct calculations.

- Subtract the total from line five from the adjusted gross income to find your taxable income. Enter this value as indicated.

- Follow the prompts to enter any federal income tax withheld. This section will ensure that your calculations accurately reflect any prepayments made throughout the year.

- Add the payments and tax amounts correctly and note if you owe or are due a refund. Complete the relevant sections with detailed calculations.

- Finally, review the filled form, saving any changes you've made, and then you may choose to download, print, or share the completed form securely.

Start your document filing process online today and ensure your tax submissions are accurate and timely.

Common tax mistakes include failing to file on time, entering incorrect Social Security numbers, and forgetting to report all income. Many taxpayers overlook essential IRS forms to print, which can lead to errors. Being aware of these pitfalls ensures you maximize your deductions and minimize any potential penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.