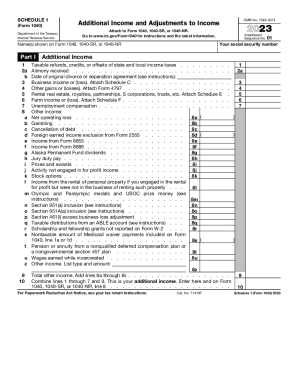

Get 2023 Schedule 1 (form 1040). Additional Income And Adjustments To Income

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2023 Schedule 1 (Form 1040). Additional Income And Adjustments To Income online

This guide provides detailed instructions on how to accurately complete the 2023 Schedule 1 (Form 1040), which is essential for reporting additional income and adjustments to income. By following these steps, users can ensure they provide all necessary information correctly and efficiently.

Follow the steps to complete the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your social security number in the designated field at the top of the form.

- Provide the name(s) shown on your Form 1040, 1040-SR, or 1040-NR.

- In Part I, list any additional income. Start with line 1 for taxable refunds, credits, or offsets of state and local income taxes.

- Continue to complete line 2a for any alimony received, including the date of the original divorce or separation agreement on line 2b.

- For business income or loss, attach Schedule C and enter the amount on line 3. Follow similar instructions for other income sources listed in the subsequent lines.

- In line 9, total your other income by adding lines 8a through 8z, and in line 10, combine all amounts from lines 1 through 7 and 9; enter this total on Form 1040, 1040-SR, or 1040-NR, line 8.

- In Part II, provide any adjustments to income starting from line 11 for educator expenses, continuing down the list of adjustments.

- For each applicable deduction, refer to the associated forms if required, such as Form 8889 for health savings account deductions.

- Finally, add lines 11 through 23 and 25 to get your total adjustments to income in line 26. Transfer this figure to Form 1040, 1040-SR, or 1040-NR, line 10.

- Once all sections are completed, save any changes made to the form, and explore options to download, print, or share the completed document.

Start filling out your documents online today to ensure accurate reporting and timely submission.

Line 11 Your adjusted gross income (AGI) consists of the total amount of income and earnings you made for the tax year minus certain adjustments to income. For tax year 2023, your AGI is on Line 11 on Form 1040, 1040-SR, and 1040-NR. It is located on different lines on forms from earlier years. How to Find Your Adjusted Gross Income (AGI) to E-file Your ... TurboTax https://turbotax.intuit.com › ... › IRS Tax Return TurboTax https://turbotax.intuit.com › ... › IRS Tax Return

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.