Get Cigarette Tax Stamp (cts) Email Request - Cdtfa - Ca.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Cigarette Tax Stamp (CTS) Email Request - CDTFA - CA.gov online

Filling out the Cigarette Tax Stamp (CTS) Email Request form is essential for individuals and businesses needing to comply with California's tax regulations regarding cigarette sales. This guide will walk you through the process of completing the form online, ensuring you have all necessary information for a successful submission.

Follow the steps to complete the Cigarette Tax Stamp Email Request online.

- Press the ‘Get Form’ button to access the form and open it in the online editor.

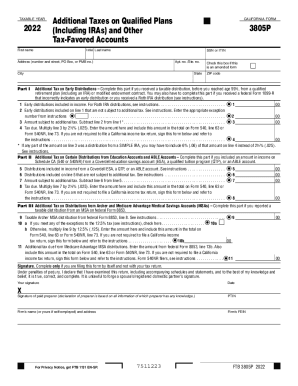

- Begin by entering the taxable year in the specified field. Ensure that you select the correct year for which you are filing.

- Provide your first name and initial last name as required. Make sure these match the identification documents.

- Input your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) in the designated field.

- Fill in your address, including the number and street, PO Box, or PMB number. If applicable, enter your apartment or suite number.

- Complete the fields for your city, state, and ZIP code. Check for accurate spelling to avoid processing delays.

- If applicable, check the box indicating that this is an amended form. This is important for reporting changes.

- Proceed to Part I, where you will provide details regarding early distributions from qualified plans. Follow the instructions to complete each line accurately.

- In Part II, similar instructions apply for any education accounts or ABLE accounts; provide the requested numbers and details.

- Continue to Part III, focusing on any taxable distributions from Archer or Medicare Advantage Medical Savings Accounts. Complete the calculations as instructed.

- Before finalizing the form, ensure you've signed and dated the section at the bottom. Your signature certifies the accuracy of the information provided.

- Upon completion, you can save changes, download the document, print it, or share it as needed.

Complete your Cigarette Tax Stamp Email Request online today to ensure compliance with California tax regulations.

Beginning July 1, 2022, retailers of electronic cigarettes (in-state or out-of-state) are required to collect from the purchaser at the time of sale the California Electronic Cigarette Excise Tax (CECET) at the rate of 12.5 percent (12.50%) of the retail selling price of electronic cigarettes containing or sold with ...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.