Loading

Get Form 6251 For 2004

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 6251 for 2004 online

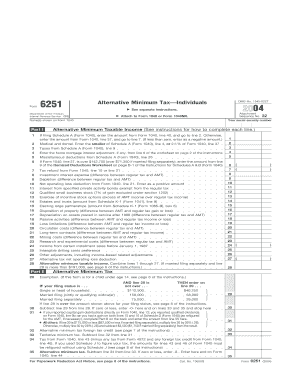

Filling out Form 6251 for the year 2004 is essential for individuals who may be subject to the alternative minimum tax. This guide provides comprehensive, step-by-step instructions to assist users in completing the form accurately online.

Follow the steps to effectively fill out Form 6251 online.

- Press the ‘Get Form’ button to access the Form 6251 and open it in your chosen platform.

- Begin by completing the top of the form with your name and Social Security number. This information is necessary for filing.

- Proceed to Part I, where you will input your alternative minimum taxable income by entering data from relevant schedules.

- For line 3, enter any adjustments such as home mortgage interest. Make sure to reference the worksheet provided in the instructions.

- Continue filling out lines 5 through 27 based on any applicable adjustments or deductions that pertain to your tax situation.

- Calculate your alternative minimum tax exemption on line 29 based on your filing status, and be sure to reference the limitations provided.

- Complete Part II by calculating your tentative minimum tax on line 31, following the instructions carefully to ensure accuracy.

- Finally, review all data entries for accuracy, and once completed, save the changes. You can download, print, or share the form as needed.

Start filing your documents online to ensure a smooth and efficient process.

To complete Form 6251 for 2004, gather records detailing income, deductions, and credits that affect your tax liability. Specifically, documents such as W-2s, 1099s, and any relevant schedules from your tax return are necessary. It's advisable to organize these records ahead of time. Platforms like US Legal Forms provide checklists to ensure you do not miss any required documentation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.