Loading

Get Vt Schedule K-1vt 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VT Schedule K-1VT online

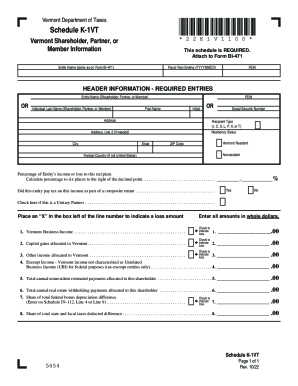

The VT Schedule K-1VT is an essential form used by shareholders, partners, and members to report income and losses in Vermont. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to complete your VT Schedule K-1VT online.

- Click ‘Get Form’ button to obtain the form and open it in the editor. This will give you access to the VT Schedule K-1VT that needs to be filled out for your tax reporting.

- Enter the entity name, ensuring it matches the name on Form BI-471, along with the fiscal year ending date in the specified format (YYYYMMDD). This is crucial for proper identification.

- Provide the federal employer identification number (FEIN) for the entity and make sure all header information is accurately filled out, including the individual last name or first name with relevant initials.

- Indicate the type of recipient by choosing from the options provided: I, C, S, L, P, X, or T, and also specify the residency status (Vermont resident or nonresident).

- Complete the address information, including any necessary details for Address Line 2, city, state, ZIP code, and, if applicable, foreign country.

- Input the social security number and the percentage of the entity's income or loss allocated to the recipient, calculated to six decimal places.

- Indicate whether the entity paid tax on this income as part of a composite return by selecting 'Yes' or 'No'.

- If applicable, check the box to indicate if the individual is a unitary partner.

- For each category of income or loss, such as Vermont business income, capital gains, other income, and exempt income, enter the respective amounts as indicated on the form.

- Ensure to check the boxes to indicate any losses for each line where applicable.

- At the end of the process, review all entries for accuracy before deciding to save changes, download, print, or share the completed form.

Complete your VT Schedule K-1VT online today to streamline your tax reporting!

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.