Loading

Get 6212 A Irs Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 6212 A IRS form online

Completing the 6212 A IRS form online can seem daunting, but with a clear guide, you can navigate the process with ease. This step-by-step guide is designed to help users understand each section of the form, ensuring accurate and efficient completion.

Follow the steps to fill out the form successfully

- Press the ‘Get Form’ button to access the form and open it in your online editor.

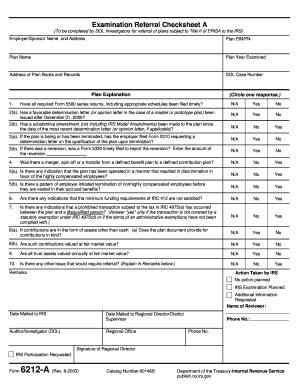

- Begin by entering the employer or sponsor name and their address in the designated fields. Be sure to provide accurate information to ensure proper identification of the plan.

- Fill in the Plan EIN/PN, which is essential for tax identification purposes. This number links the plan to the employer's tax record.

- Next, enter the Plan Name. This should reflect the official name used by the plan sponsor.

- Indicate the Plan Year Examined. This helps categorize the audit period for the IRS's review.

- Input the Address of Plan Books and Records. This is where the IRS can find detailed documentation related to the plan.

- Record the DOL Case Number, which is necessary for tracking any ongoing investigations or cases.

- Proceed to the Plan Explanation Items. Answer each question clearly, marking 'Yes,' 'No,' or 'N/A' as appropriate. Be thorough as many questions impact referrals.

- In the Remarks section, provide any additional information that could assist the IRS in understanding specific circumstances relating to the plan.

- Complete the 'Action Taken by IRS' section, based on guidance provided. Ensure all required signatures and dates are filled in accurately and completely.

- Finally, review all entries for accuracy. Once satisfied with your responses, you can save changes, download the form, print, or share it as required.

Take charge of your document management by completing forms online efficiently.

To send a fax to the IRS, first locate the appropriate fax number for your specific correspondence, which can usually be found on the IRS website. Ensure that you provide all required information and include your contact details. It’s crucial to retain proof of your fax transmission for your records. For assistance in navigating IRS communications, uslegalforms offers templates and resources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.