Get Form 720x

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 720x online

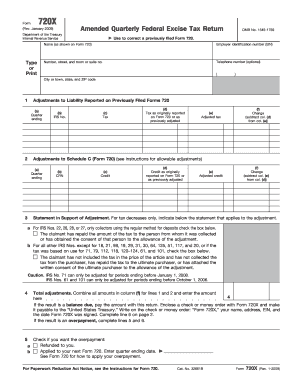

Filling out Form 720x, the amended quarterly federal excise tax return, online is a crucial step to correct previously filed excise taxes. This guide provides clear, step-by-step instructions to ensure that users can provide accurate adjustments with confidence.

Follow the steps to fill out the Form 720x online.

- Use the ‘Get Form’ button to access the form and open it in a suitable editing platform.

- Begin by entering your name as shown on the original Form 720. Provide your employer identification number (EIN), address, and telephone number in the respective fields.

- In section 1, report adjustments to your previously filed Forms 720. For each quarter ended, enter the applicable data in columns (a) through (f), indicating the original reported tax alongside the adjusted tax.

- In section 2, document any adjustments to credits for Schedule C (Form 720) using the specified IRS numbers. Enter necessary details in columns (a) through (f) similarly as before.

- Provide a statement in support of adjustment, checking the appropriate boxes based on your circumstances. If you're submitting adjustments for tax decreases, include the necessary verification.

- Calculate the total adjustments by combining amounts entered in column (f) for lines 1 and 2, and complete line 4 accordingly.

- Indicate your preference for handling any overpayment by checking boxes for either a refund or applying it to your next Form 720.

- On line 6, provide a detailed explanation of adjustments made, attaching additional sheets if necessary for clarity.

- Before submission, ensure your form is signed and dated in the designated area. This step is critical for validating the submission.

- Finally, save your changes, and you have the option to download, print, or share the form as needed.

Complete your documents online with confidence today.

To fill out an income tax return form, start by gathering all your financial documents, including W-2s, 1099s, and receipts for deductions. You can use tax software or online services that guide you through the process. While Form 720 primarily deals with excise taxes, knowing how to prepare your income tax helps you manage your overall tax situation better. Always double-check your entries, and consider using services like US Legal Forms for added assistance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.