Loading

Get Nyc 200v

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nyc 200v online

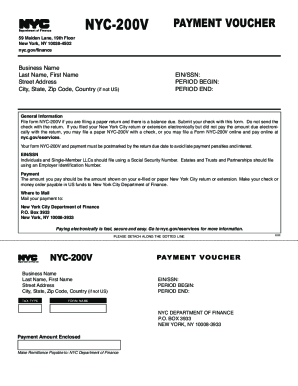

Filing the Nyc 200v is an essential step for individuals and businesses with a balance due when submitting their tax returns. This guide provides detailed instructions on how to fill out this payment voucher online, ensuring a smooth and accurate process.

Follow the steps to complete the Nyc 200v form online.

- Click the ‘Get Form’ button to access the Nyc 200v and open it in the online editor.

- Enter your business name and your last name, followed by your first name. This identification is essential for processing your payment.

- Provide your street address, followed by your city, state, and zip code. If applicable, include your country.

- Indicate your EIN or SSN. Note that individuals and single-member LLCs should use their Social Security Number, while estates, trusts, and partnerships must enter their Employer Identification Number.

- Fill out the period begin and period end fields to specify the timeframe for which you are making this payment.

- In the payment amount enclosed section, ensure that you accurately enter the total amount due as shown on your e-filed or paper New York City return or extension.

- Once all fields are completed, review the information to ensure accuracy. Save any changes you have made.

- Finally, choose to download, print, or share the completed form for your records and submission.

Complete your Nyc 200v form online today for a hassle-free tax filing experience.

The New York (NY) state sales tax rate is currently 4%. Depending on local municipalities, the total tax rate can be as high as 8.875%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.