Loading

Get 2010 Form 8815

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2010 Form 8815 online

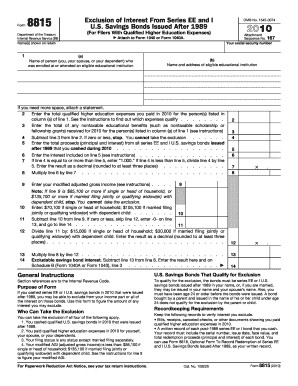

Filling out the 2010 Form 8815 can seem daunting, but with clear guidance, you can complete it accurately and efficiently. This form is used to determine the exclusion of interest from U.S. savings bonds if you have qualified higher education expenses. Follow this guide for a step-by-step walkthrough of the process.

Follow the steps to fill out the 2010 Form 8815 online with ease.

- Click 'Get Form' button to obtain the form and open it in your preferred PDF editor.

- In Line 1, enter the name(s) of the person(s) enrolled at or who attended an eligible educational institution during 2010, along with their social security number.

- In Line 2, input the total qualified higher education expenses you paid for the individual(s) listed. Refer to the instructions to identify which expenses qualify.

- In Line 3, enter the total of any nontaxable educational benefits received for the same individual(s) in 2010, such as scholarships or fellowship grants.

- Subtract the amount in Line 3 from Line 2 and record the result in Line 4. If the result is zero or less, you are not eligible for the exclusion.

- For Line 5, input the total proceeds from all series EE and I U.S. savings bonds you cashed during 2010.

- In Line 6, enter the interest included in the amount from Line 5.

- In Line 7, determine if your results from Line 4 are less than Line 5, and perform the division to calculate the appropriate decimal.

- Multiply the amount from Line 6 by the decimal result in Line 7 and enter it in Line 8.

- In Line 9, write your modified adjusted gross income. Follow the instructions to calculate this accurately.

- Complete Line 10 by dividing the result from Line 9 according to your filing status.

- Continue as outlined in the form instructions until you reach Line 14. If applicable, enter excludable savings bond interest and follow instructions for further calculations.

- Once you have filled in all necessary fields, you can save your changes, download, print, or securely share the completed form.

Begin the process of completing your 2010 Form 8815 online today.

To reissue a US savings bond, you will need to fill out the appropriate form and submit it to the Treasury Department. This process can ensure that the bond is transferred correctly. For necessary forms, you might find resources such as the 2010 Form 8815 helpful in your financial planning.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.