Loading

Get Filable Form 8453 S 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Filable Form 8453 S 2010 online

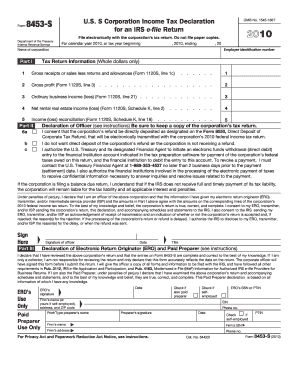

Filling out the Filable Form 8453 S 2010 online can seem daunting, but this guide is designed to walk you through each section of the form with clarity and ease. By following these steps, you can efficiently and accurately complete your tax declaration for your S corporation.

Follow the steps to fill out the Filable Form 8453 S 2010 online.

- Press the ‘Get Form’ button to access the form and open it in your editor.

- Enter the corporation's employer identification number (EIN) in the appropriate field.

- Type the name of the corporation in the designated area.

- Complete Part I by entering the monetary figures for gross receipts, gross profit, and ordinary business income (loss) as required, using whole dollars only.

- For line 6, make sure to check off the applicable boxes regarding direct deposit preferences and authorization for electronic funds withdrawal.

- In Part II, the corporate officer must sign and date the form, attesting to the accuracy of the information provided.

- If applicable, complete Part III by ensuring that any electronic return originator (ERO) or paid preparer signs where required.

- Once all sections are filled, you can save the changes, download the completed form, print it, or share it as needed.

Now that you have the steps, start completing your documents online for a smoother filing experience.

To save a tax return as a PDF, finish filling out your tax return using your preferred tax software. Once complete, look for an option that allows you to export or save the document as a PDF. Choosing this option will create a PDF version of your tax return, making it easy to share and store securely.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.