Loading

Get Hi Bfs-rp-p-51 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI BFS-RP-P-51 online

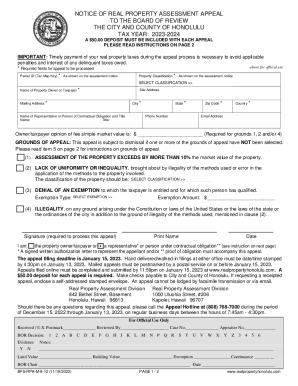

Filling out the HI BFS-RP-P-51 is an important step in appealing your property assessment. This guide provides you with simple, clear, and step-by-step instructions to help you complete the form accurately.

Follow the steps to successfully complete your appeal form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your Parcel ID (Tax Map Key) as shown on the assessment notice in the designated field. This is a required field for your appeal to be processed.

- Next, select the Property Classification from the provided options, based on information from your assessment notice. Ensure that this classification matches the details on your notice.

- Fill in the Name of Property Owner or Taxpayer in the corresponding field. This helps identify who is filing the appeal.

- Input your Mailing Address, Site Address, City, State, Zip Code, and Country. Providing a complete address is essential for any correspondence related to your appeal.

- Enter your Phone Number and Email Address. These contact details are critical for notifications regarding your appeal.

- Provide your opinion of the fee simple market value of the property, which is required for certain grounds of appeal. Enter this value in the appropriate space provided.

- Select the grounds of appeal that apply to your case. You may choose more than one option, but ensure that at least one box is checked to avoid dismissal of your appeal.

- If applicable, provide the exemption type and amount if you are appealing based on denial of an exemption.

- Sign the form to validate your appeal. Print your name and date the document. Check the box indicating your relationship, either as the property owner/taxpayer or a representative.

- Ensure you include the required $50.00 deposit with your appeal submission. Make checks payable to City and County of Honolulu.

- Review the completed form for accuracy and completeness. Once satisfied, you can then save changes, and choose to download, print, or share the form.

Begin the process of completing your property assessment appeal online today.

The state of Hawaii has the lowest property tax rate in the nation at 0.27%. Despite this, the median annual tax payment in the state is $1,971, which is much higher. This is because Hawaii has the highest median home value in the U.S. at $772,500. Not in Hawaii?

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.