Loading

Get How To Fill Out And File A Sched K-1 Taxes S2e44 - Youtube

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and file a Schedule K-1 Taxes S2E44 online

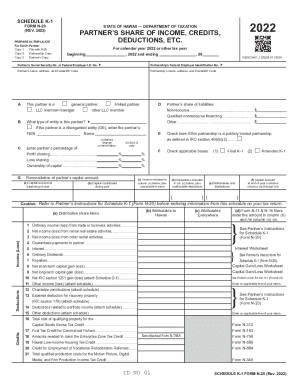

This guide provides clear instructions on how to complete and file the Schedule K-1 Tax form online. Designed for ease of understanding, this resource will help users accurately fill out the required fields and ensure a smooth filing process.

Follow the steps to effectively complete your Schedule K-1 form.

- Click ‘Get Form’ button to access the Schedule K-1 form and open it in your desired editing tool.

- Enter the required information for the partner’s share of income, credits, deductions, etc. Begin with the partner’s Social Security number or Federal Employer Identification number, followed by the partnership’s Federal Employer Identification number.

- Fill in the partner’s name, address, and Postal/ZIP code along with the partnership’s name, address, and Postal/ZIP code.

- Indicate the type of partner by checking one of the boxes, such as general partner, limited partner, or LLC member. If applicable, specify the partner’s type of entity.

- Input the partner’s share of liabilities in the designated fields for nonrecourse and qualified nonrecourse financing.

- Check the box if the partnership qualifies as a publicly traded partnership.

- Specify the partner’s percentage of profit sharing, loss sharing, and ownership of capital by filling in the appropriate fields.

- Complete the reconciliation of the partner’s capital account, ensuring you include all necessary information regarding capital contributions and deductions.

- Proceed to fill out the detailed distributive share items, which include income, losses, and credits. Make sure to input the correct amounts into the respective columns, as indicated.

- Review all entries for accuracy and completeness before finalizing the form.

- Once completed, save your changes and choose to download, print, or share the form as needed.

Start filling out your Schedule K-1 tax form online today!

To enter the K-3: Open the Schedule K-1 Worksheet. Scroll down to the Foreign Transactions line: For partners, this is line 16. For shareholders, this is line 14. Check the Schedule K-3 is attached if checked box. Enter the Name of Country or U.S. Possession. Complete lines B through AI based on the K-3 received.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.