Loading

Get Form 6198 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 6198 Instructions online

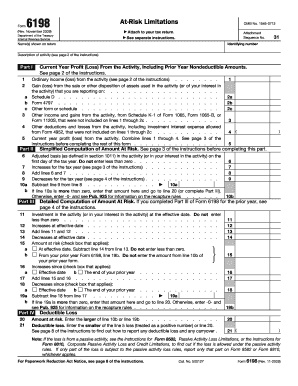

Filling out the Form 6198 is essential for reporting at-risk limitations associated with activities you are involved in. This guide provides clear, step-by-step instructions to help you efficiently complete and submit the form online.

Follow the steps to successfully complete Form 6198 online.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by entering your identifying number at the top of the form, followed by the name(s) as they appear on your tax return.

- In the description of activity section, briefly explain the nature of the activity for which you are reporting.

- Proceed to Part I, where you will report the current year profit or loss from the activity. Start with line 1, entering any ordinary income or loss from the activity.

- Continue to lines 2 and 3 to report gain or loss from the sale or disposition of assets related to the activity. Make sure to indicate if you are using other forms like Schedule D or Form 4797.

- Fill out line 4 by reporting other deductions and losses that were not previously included in lines 1 through 3.

- Combine the totals from lines 1 through 4 on line 5 to calculate the current year profit or loss from the activity.

- Move to Part II to simplify the computation of the amount at risk. Start by entering your adjusted basis in the activity on line 6.

- On line 7, report any increases for the tax year. Then, add lines 6 and 7 on line 8.

- Report any decreases for the tax year on line 9 and subtract this from the total on line 8 to complete line 10a.

- Based on your calculations, follow through to lines in Part III for a detailed computation of the amount at risk and complete Part IV for deductible loss.

- Review all entries, ensure accuracy, and then finalize the process by either saving changes, downloading, printing, or sharing the completed form.

Take the next step in your filing process by completing the Form 6198 online today.

Filling an investment proof submission form involves stating your investment details and providing supporting documents. Make sure to accurately report all investment amounts and relevant information. To ease this process, look at the Form 6198 Instructions; they can guide you step by step.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.