Get 2010 Form 4835

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2010 Form 4835 online

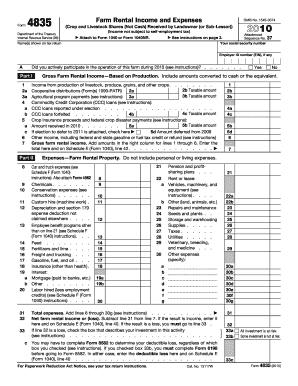

Filling out the 2010 Form 4835 online can streamline your tax reporting process related to farm rental income. This guide provides a clear, step-by-step walkthrough to help you accurately complete the form with confidence.

Follow the steps to efficiently complete the 2010 Form 4835 online.

- Use the ‘Get Form’ button to acquire the 2010 Form 4835 and open it in your browser for editing.

- Enter your social security number in the designated field at the top of the form. This number is essential for identification purposes.

- Provide the name(s) as shown on your tax return. This should include your legal name and, if applicable, the name of your partner.

- If you have an employer identification number (EIN), fill that in; otherwise, leave it blank.

- Indicate whether you actively participated in the farm operation during the year by checking 'Yes' or 'No' in Line A.

- In Part I, report your gross farm rental income based on production. Complete lines 1 through 6 to include income from livestock and crops.

- In Part II, detail your expenses related to the farm rental property. Fill lines 8 through 30g with the appropriate figures reflecting your operational costs.

- Calculate your total expenses by adding all amounts reported in lines 8 through 30g. Enter this total on line 31.

- Subtract line 31 from line 7 to determine your net farm rental income or loss. Enter this amount on line 32.

- If necessary, complete any additional forms referenced, such as Form 8582, if your net result warrants this step.

- Lastly, save your completed form. You can download, print, or share the form as required.

Complete your tax documents online to ensure timely and accurate submissions.

Line 2a on Form 1040 refers to the amount of taxable interest income that a taxpayer reports. This section is important when completing the 2010 Form 4835, as it helps determine your overall financial picture for the year. Proper understanding of this line ensures that you do not overlook any interest income that can affect your tax obligations. With US Legal Forms, you can access resources to clarify these details and streamline your filing process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.