Loading

Get 2010 Form 945

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

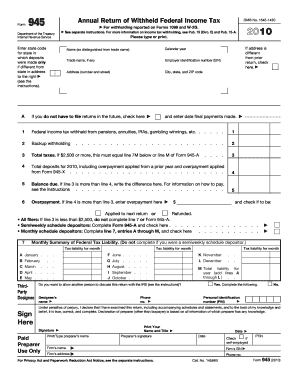

How to fill out the 2010 Form 945 online

Filling out the 2010 Form 945 online is a straightforward process that assists users in reporting withheld federal income tax. This guide will provide clear instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the form correctly.

- Click the ‘Get Form’ button to access the form online and open it in the editor.

- Enter your employer identification number (EIN) in the designated field. If you do not have an EIN, you should apply for one using Form SS-4 and write 'Applied For' along with the date in this space.

- Complete your business name and trade name if applicable. Ensure the address section contains your accurate number, street, city, state, and ZIP code. If your address has changed since your last return, check the relevant box.

- Enter the calendar year for which you are filing the form.

- Input the federal income tax withheld amounts from various sources, such as pensions and annuities, in the appropriate fields. Complete line 1 for total withheld and line 2 for any backup withholding.

- Calculate the total taxes owed in line 3, and if this amount is $2,500 or more, ensure this matches the figures in line 7M or line M of Form 945-A.

- Next, report total deposits made for 2010 on line 4, accounting for any overpayment from a prior year or Form 945-X.

- Determine if you have a balance due by subtracting line 4 from line 3. If line 3 exceeds line 4, record the difference in line 5.

- If you have overpayment, enter this on the form, select whether it will be applied to the next return or refunded, and fill in the relevant information.

- Complete any remaining lines as specified for monthly or semiweekly schedule depositors, if applicable.

- Designate a third-party designee if needed by providing the designee’s name and contact number, and input your personal identification number (PIN) if this applies.

- Sign and date the form at the bottom section to certify that the information provided is accurate.

- Review all entries for accuracy, then save your changes. You can download, print, or share the completed form as required.

Start completing your 2010 Form 945 online today to ensure timely and accurate filing.

The 2010 Form 945 document is an IRS tax form specifically designed for reporting withheld federal income tax from nonpayroll sources. This includes payments such as pensions and annuities. By understanding and utilizing this document, you can manage your tax obligations effectively and stay organized throughout the filing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.