Loading

Get Cert-106, Claim For Refund Of Use Tax Paid On Motor ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CERT-106, Claim For Refund Of Use Tax Paid On Motor Vehicle online

Filing a claim for a refund of use tax paid on a motor vehicle can be a straightforward process if you follow the appropriate steps. This guide will walk you through filling out the CERT-106 form online, ensuring you provide all necessary information for a smooth submission.

Follow the steps to complete your CERT-106 form accurately

- Click the ‘Get Form’ button to obtain the CERT-106 form and open it in the editor.

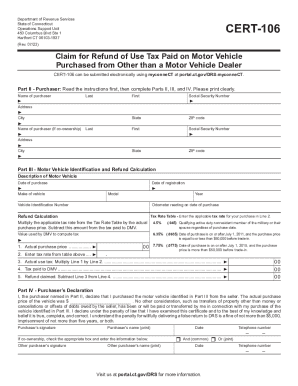

- Fill out Part II, which includes your personal details. Provide your name, Social Security number, address, and city/state/ZIP code. If the vehicle is co-owned, complete the additional purchaser's information.

- Proceed to Part III to describe the motor vehicle. Enter the make, model, Vehicle Identification Number (VIN), year, purchase date, and registration date. Also, provide the odometer reading and refer to the Tax Rate Table to determine the applicable tax rate.

- In the Refund Calculation section, complete the calculations based on the information you provided. Start with the actual purchase price in Line 1, then multiply this amount by the tax rate from the Tax Rate Table, and enter that result in Line 3. Complete Line 4 with the tax amount paid to the DMV and calculate your refund amount in Line 5.

- Complete Part IV, the Purchaser’s Declaration, by signing and printing your name. If co-owned, ensure to have the other purchaser's signature and details.

- Once the form is complete, review all entries for accuracy. You can then save your changes, download the form, and print a copy for your records. Finally, share the completed form as needed.

Complete your CERT-106 form online today and ensure your claim for refund is processed efficiently.

Sales tax is charged at a rate of 6.35% (vessels and trailers that transport vessels are at 2.99% sales tax rate), except for those vehicles that are exempt from sales tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.