Loading

Get Failure To File Form Ct-706 Nt Ext

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Failure To File Form CT-706 NT EXT online

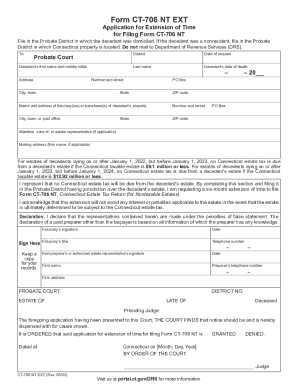

Filling out the Failure To File Form CT-706 NT EXT is an important step for individuals managing an estate in Connecticut. This guide provides a clear and comprehensive approach to completing the form online, ensuring users understand each section and what information is needed.

Follow the steps to fill out the form correctly.

- Press the ‘Get Form’ button to acquire the form and open it in the editor.

- Indicate the Probate District where the decedent was domiciled by selecting the correct district from the options provided.

- Fill in the decedent’s first name, middle initial, last name, and date of death. Ensure the information is accurate and complete.

- Provide the complete address of the decedent, including number and street, city or town, state, and ZIP code.

- Enter the name and address of the fiduciary or transferee of the decedent's property. If there is no fiduciary, you may enter the details of the person in possession of the property.

- If applicable, include additional contact information for the fiduciary, such as a firm name or estate representative's details.

- Sign and date the form to confirm the information is correct. If applicable, a paid preparer's or authorized estate representative's signature should also be included.

- Submit the completed form to the appropriate Probate Court, ensuring it is filed by the original due date. Keep a copy of the form for your records.

Complete your documents online to streamline the management of your estate.

Income tax on income generated by assets of the estate of the deceased. If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.