Loading

Get Form 7004 Instructions 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 7004 Instructions 2011 online

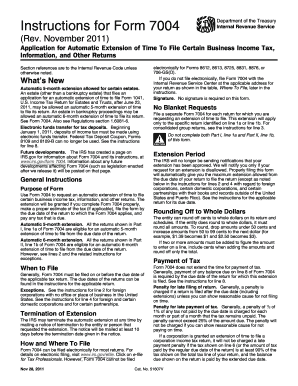

Filling out Form 7004 is crucial for businesses seeking an automatic extension of time to file their tax returns. This guide will provide a detailed, step-by-step approach to completing the form online, ensuring that you meet all necessary requirements.

Follow the steps to complete Form 7004 online effectively.

- Press the ‘Get Form’ button to acquire the form and open it in your preferred editor.

- Complete your name and identifying number accurately on the form. Ensure that the name matches what you submitted on your last tax return.

- Fill in your address, including any suite or unit number. If applicable, use a P.O. box instead of a street address.

- In Part I, line 1a, indicate the type of return for which you are requesting an automatic 5-month extension by entering the appropriate Form Code.

- If applicable, in Part II, line 1b, enter the Form Code for an automatic 6-month extension. Remember that you can choose only one option; do not fill both lines.

- Provide the tax year beginning and ending dates if you do not follow a calendar year.

- Estimate the total tax expected for the tax year on line 6. Input zero if you believe you owe nothing.

- Document any payments or refundable credits expected to receive on line 7. This includes writing in extra payments if necessary.

- On line 8, enter the total unpaid tax liability expected by the due date of the return. Make sure to pay as much as possible to reduce potential penalties.

- Once you have completed the form, you can save the changes, download, print, or share the completed Form 7004.

Get started today and complete your Form 7004 online for a hassle-free filing experience.

Accessing a tax return form is simple. You can go to the IRS website and navigate to the appropriate section or utilize an online tax service that offers IRS forms. If you need help during the process, refer to the Form 7004 Instructions 2011 for clarity on which forms to access based on your situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.