Loading

Get Sales And Use Tax Refund Checklist

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sales And Use Tax Refund Checklist online

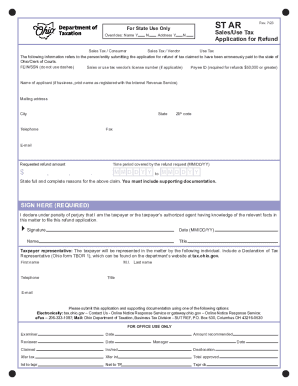

Filing a Sales And Use Tax Refund Checklist online can be a straightforward process when you understand each section of the form. This guide will walk you through the necessary steps to ensure your refund application is completed accurately and efficiently.

Follow the steps to effectively complete your refund application.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your federal employer identification number (FEIN) or social security number (SSN), ensuring that no dashes are included.

- Provide your sales or use tax vendor's license number if applicable, as well as your payee ID if your refund request is for $50,000 or greater.

- In the 'Name of applicant' field, print the name of the person or entity submitting the application as registered with the Internal Revenue Service.

- Fill in the mailing address, city, state, telephone number, ZIP code, fax number, and email address.

- Specify the requested refund amount in US dollars.

- Indicate the time period covered by the refund request by entering the start and end dates in the MM/DD/YY format.

- Clearly state the reasons for your refund claim in the designated area. Be sure to include any necessary supporting documentation that justifies your claim.

- Sign and date the form, confirming your declaration under penalty of perjury that you are the taxpayer or authorized agent.

- If applicable, provide the representative's first name, middle initial, last name, title, telephone number, and email address.

- Once all fields are completed, you may save changes, download, print, or share the form as needed.

Get started on your application by completing the Sales And Use Tax Refund Checklist online today.

Related links form

What are the sales and use tax rates in Nebraska? The Nebraska state sales and use tax rate is 5.5%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.