Loading

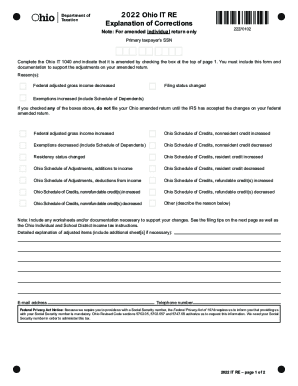

Get 2022 Ohio It Re Explanation Of Corrections

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2022 Ohio IT RE Explanation Of Corrections online

Filling out the 2022 Ohio IT RE Explanation Of Corrections form online can seem overwhelming. This guide provides clear, step-by-step instructions to help you successfully complete the form and submit your corrections accurately.

Follow the steps to fill out the 2022 Ohio IT RE Explanation Of Corrections form online.

- Click the ‘Get Form’ button to access the form and open it in your editing tool.

- In the primary taxpayer's SSN field, enter the Social Security number of the primary taxpayer. Ensure the number is correct to avoid any processing delays.

- Complete the Ohio IT 1040 form and indicate that it is an amended return by checking the appropriate box at the top of page 1. This form must accompany your Explanation Of Corrections.

- In the 'Reason(s)' section, select the reasons for your amendments by checking the relevant boxes. Ensure you have supporting documentation ready for any adjustments listed.

- For each checked reason, provide a detailed explanation of adjusted items in the designated area. If necessary, include additional sheets with your explanation.

- Enter your email address and telephone number in the respective fields for any communication regarding your corrections.

- Review all the information entered to confirm accuracy and completeness. This reduces the chance of future issues with your amended return.

- Once you have completed the form, you can save your changes, download the form for your records, print it, or share it as needed.

Start completing your 2022 Ohio IT RE Explanation Of Corrections online today to ensure your amendments are processed smoothly.

Limitation of the $20 personal exemption credit to those with Ohio Taxable Income of less than $30,000 a year. Expanded personal exemptions for those making $80,000 or less. Means testing of the senior and retirement income credits at $100,000. Sales tax increase from 5% to 5.75%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.