Get Form 5074 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5074 2011 online

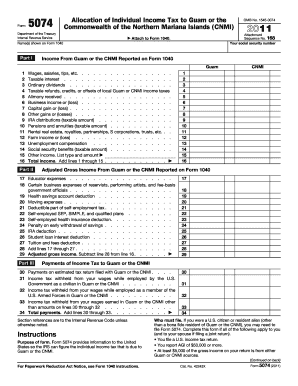

Filling out the Form 5074 2011 online can streamline your reporting process to the Internal Revenue Service. This guide provides clear instructions on how to complete the form effectively, ensuring that you meet all necessary requirements for income tax allocation to Guam or the Commonwealth of the Northern Mariana Islands.

Follow the steps to accurately complete your Form 5074 2011 online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter your social security number in the designated field at the top of the form. This ensures that your income reporting is accurately linked to your personal identification.

- Provide your name as it appears on Form 1040. If filing jointly, include both partners' names as shown on their tax return.

- In Part I, report income from Guam or CNMI. Fill in the appropriate fields with your income types, such as wages, salaries, interest, and dividends, using the lines numbered 1 to 15.

- Calculate your total income by adding the amounts reported on lines 1 through 15, then write the total on the specified line.

- Proceed to Part II and enter your adjusted gross income. Follow the instructions carefully to compute deductions such as educator expenses and penalties on early withdrawals, entering them as instructed from lines 17 to 28.

- In Part III, report any payments made on estimated tax returns and any income tax withheld, adding these amounts accurately to ensure proper reporting on lines 30 through 34.

- Review your completed form for accuracy. Ensure all fields are filled out correctly and double-check the computations for any totals.

- After thorough review, save your changes. You may also choose to download, print, or share the completed form as required for your tax filing.

Complete your Form 5074 2011 online today to ensure accurate reporting and compliance with tax regulations.

Filing SA900 involves reporting your income and expenses related to self-assessment. Begin by collecting all relevant documents that support your claims. After completing the form accurately, submit it before the tax deadline to avoid penalties. For those navigating various forms, including Form 5074 2011, uslegalforms can provide helpful guidance throughout the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.