Loading

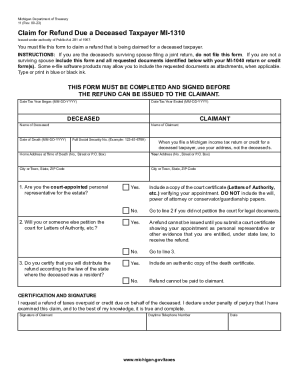

Get Claim For Refund Due A Deceased Taxpayer Mi-1310. Claim For Refund Due A Deceased Taxpayer Mi-1310

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Claim For Refund Due A Deceased Taxpayer MI-1310 online

Filing the Claim For Refund Due A Deceased Taxpayer MI-1310 is an important process for obtaining tax refunds owed to someone who has passed away. This guide will provide you with clear, step-by-step instructions for completing the form accurately and efficiently.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the date the tax year began in the format MM-DD-YYYY.

- Provide the name of the deceased person as it appears on their legal documents.

- Input the date of death using the MM-DD-YYYY format.

- Next, indicate the date the tax year ended, again using MM-DD-YYYY format.

- Fill in your name as the claimant. Ensure to include your full Social Security number in the specified format.

- Write down the home address of the deceased at the time of death, using complete address information.

- Enter your current address in the corresponding section, including city, state, and ZIP code.

- Respond to the question about being the court-appointed personal representative for the estate by checking 'Yes' or 'No.'

- If you answered 'Yes' to step 9, include a copy of the court certificate verifying your appointment.

- Answer whether you will petition the court for Letters of Authority, and provide the necessary documents if applicable.

- If required, include an authentic copy of the death certificate.

- Finally, read the certification statement carefully, then sign and date the form, and include your daytime telephone number.

- Once the form is completed, you can save, download, print, or share it as needed.

Complete your documents online today and ensure you receive the necessary refunds.

Form 1310 is a tax form that is filed with the IRS to request a tax refund for a deceased individual. This form is typically filed by a surviving spouse, another beneficiary, or the executor of the deceased's estate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.