Loading

Get Ohio Tax Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ohio Tax Forms online

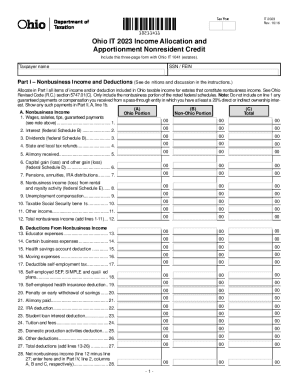

Filling out the Ohio Tax Forms online can be a straightforward process if you follow the right steps. This guide provides you with detailed instructions on how to complete the Ohio IT 2023 form efficiently and correctly.

Follow the steps to fill out your Ohio Tax Forms with ease.

- Click ‘Get Form’ button to obtain the Ohio IT 2023 form and open it in your browser.

- Begin filling out the form by entering the taxpayer name and SSN or FEIN at the top of the document. Ensure that this information is accurate as it will be used to identify your tax filing.

- Navigate to Part I, which focuses on Nonbusiness Income and Deductions. Enter any applicable nonbusiness income in columns A (Ohio Portion) and B (Non-Ohio Portion) according to your income sources, such as wages, interest, or dividends.

- Complete any deductions from Nonbusiness Income in the corresponding section of Part I. This includes entering amounts for educator expenses, health savings accounts, and other specified deductions.

- Transition to Part II, where you will report Business Income. Fill in all relevant income details, including self-employment income or guaranteed payments from pass-through entities, while also providing any necessary deductions.

- Proceed to Part III, where you will calculate the Apportionment Formula for Business Income. This requires entering information regarding property, payroll, and sales, which will help determine your Ohio apportionment ratio.

- In Part IV, summarize your Business and Nonbusiness Income. Here, you will compile figures from the previous parts to present a comprehensive view of your income both within and outside of Ohio.

- Review the form for accuracy and completeness. Ensure all sections have been duly filled and that no required information is missing.

- Upon finishing, use the provided options to save your changes, download the document, or print it out for your records.

Complete your Ohio Tax Forms online today to ensure accurate and timely filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The Ohio Department of Taxation provides a searchable repository of individual tax forms for multiple purposes. Most forms are available for download and some can be filled or filed online.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.