Get 2011 Form 2555

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Form 2555 online

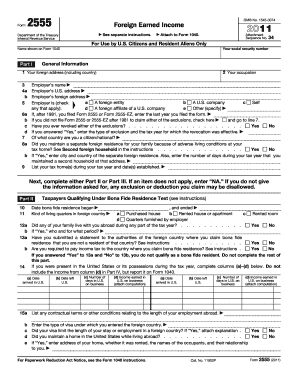

Filling out the 2011 Form 2555 online can provide significant benefits for individuals living abroad, as it allows for the exclusion of foreign earned income. This guide outlines the steps to successfully complete the form in an easy-to-follow manner.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the 2011 Form 2555 and open it in the editor.

- Fill out your personal information in Part I, including your social security number, name, and foreign address. Ensure that you provide complete and accurate details to avoid processing delays.

- Indicate your occupation and provide the names and addresses of your employers—both in the U.S. and abroad—in the relevant sections. This helps establish your work context during the tax year.

- Respond to questions about previous filings of the form, citizenship, and residency conditions by checking the appropriate boxes and providing additional information as required.

- If applicable, proceed to either Part II (Bona Fide Residence Test) or Part III (Physical Presence Test) and fill out the required information based on your circumstances during the tax year.

- Complete Part IV by accurately reporting all foreign earned income, ensuring that you convert amounts into U.S. dollars and document them based on actual or constructive receipt.

- If claiming housing exclusion or deduction, fill out Parts VI and VII by providing calculations based on your housing expenses and income earned while fulfilling the requirements stipulated by the IRS.

- Review all information for accuracy and completeness before finalizing the form. Ensure all relevant attachments are ready for submission if necessary.

- Save your completed form, then download, print, or share it as instructed for your records or future submissions.

Complete your 2011 Form 2555 online to ensure you claim the necessary exclusions and deductions effectively.

Related links form

To determine if you qualify for the foreign earned income exclusion, you need to evaluate your residency status and the source of your income. If you meet the physical presence test or the bona fide residence test while earning income abroad, you could be eligible. Consulting with tax professionals or using services like USLegalForms can provide clarity and ensure you navigate the qualification criteria properly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.