Loading

Get 2023 I-0103 Schedule Sb - Form 1 - Subtractions From Income (fillable)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

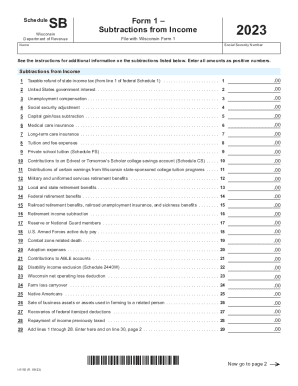

How to fill out the 2023 I-0103 Schedule SB - Form 1 - Subtractions From Income (fillable) online

Completing the 2023 I-0103 Schedule SB - Form 1 - Subtractions From Income online can simplify your filing process. This guide provides clear, step-by-step instructions to help you accurately fill out the form, ensuring that you include all relevant information for subtractions from income.

Follow the steps to correctly complete the form online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editing environment.

- Begin by entering your name and Social Security Number at the top of the form. Ensure that all information is accurate to prevent processing delays.

- Review the list of subtractions from income. Each line corresponds to specific categories, such as taxable refunds, U.S. government interest, and unemployment compensation. Enter the appropriate amounts for the categories that apply to you, ensuring all figures are entered as positive numbers.

- After completing the first page, proceed to page two. Enter the total from line 29 on line 30 to carry forward your total subtractions.

- Continue filling in the remaining fields on page two, including any human organ donation expenses, income from related entities, and adjustments for tax-option (S) corporations. Be thorough and review each entry carefully.

- Once all sections are completed, ensure that the total subtraction from income on line 50 is correct. This total should be entered on Form 1, line 6.

- Finally, save your changes to the document. You have the option to download, print, or share the completed form as needed for your records or filing.

Complete your 2023 I-0103 Schedule SB - Form 1 online today for a smoother filing experience.

All tax filers can claim this deduction unless they choose to itemize their deductions. For the 2022 tax year, the standard deduction is $12,950 for single filers ($13,850 in 2023), $25,900 for joint filers ($27,700 in 2023) and $19,400 for heads of household ($20,800 in 2023).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.