Loading

Get 53 E25 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 53 E25 Form online

Completing the 53 E25 Form online can be straightforward when you follow the provided steps. This guide offers detailed instructions to help you accurately fill out each section and ensure compliance with the requirements.

Follow the steps to fill out the 53 E25 Form online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

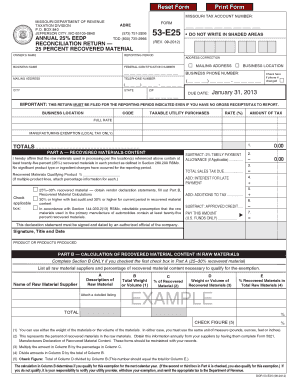

- Begin by entering your Missouri tax account number at the top of the form. This helps identify your business with the Missouri Department of Revenue.

- Provide your business name and federal identification number. Ensure that these details match your official records.

- Fill in your mailing address, including city, state, and zip code. If your address has changed, check the box provided to indicate this.

- Enter your business location and phone numbers, ensuring accuracy for correspondence and inquiries.

- Indicate the reporting period for which you are filing the form.

- In Part A, affirm that the raw materials used contain at least 25% recovered materials by checking the appropriate box and providing details as necessary.

- Complete Part B only if applicable, listing raw material suppliers along with their respective percentages of recovered material content.

- In Part C, detail your taxable equipment listing, including estimated usage metrics. Attach a detailed listing for any additional context.

- Use Part D to calculate and report the total electricity used, taxable electricity, and exempt electricity used.

- If this is your final return, indicate the closing date and select the reason for closing your account.

- Finish by signing and dating the form either as the taxpayer or an authorized agent. Ensure all calculations are accurate before submission.

- Save changes to the form, download a copy for your records, and print or share as needed.

Start filling out your 53 E25 Form online today to ensure timely and accurate filing!

Related links form

Getting a Missouri tax exempt letter involves submitting an application to the Missouri Department of Revenue. Make sure to gather all required documentation to support your exemption claim. For additional assistance, US Legal Forms provides templates and guides that can help you with necessary forms like the 53 E25 Form for tax exemption.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.