Get Hsa Payroll Deduction Form School District

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hsa Payroll Deduction Form School District online

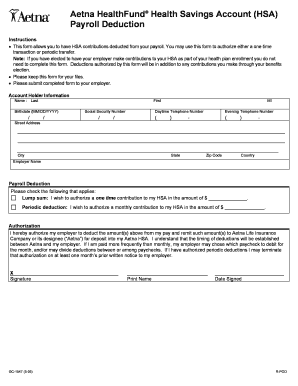

The Hsa Payroll Deduction Form School District is an essential document that allows users to authorize payroll contributions to their Health Savings Account (HSA). This guide outlines the steps needed to accurately fill out the form online, enabling users to manage their HSA contributions efficiently.

Follow the steps to complete the form easily and accurately.

- Click ‘Get Form’ button to download the form and open it in your selected editor.

- Begin by filling out the account holder information. Enter your last name, first name, middle initial, birthdate (in MM/DD/YYYY format), and Social Security Number. Ensure that your daytime and evening phone numbers are included for contact purposes.

- Next, provide your street address, city, state, zip code, and country. This information helps to verify your identity and your HSA account details.

- In the employer name section, write the name of your employer. This is necessary for your employer to process the payroll deductions accurately.

- Indicate your preferred payroll deduction option. Choose between ‘Lump sum’ for a one-time contribution or ‘Periodic deduction’ for monthly contributions. Fill in the respective amount in the designated spaces to specify how much you want to contribute.

- Review the authorization section carefully. You are required to authorize your employer to deduct the specified amounts from your pay and remit them to Aetna. Make sure you understand the conditions regarding the timing of deductions.

- After reviewing, sign the form in the designated area to authorize the deductions. Make sure to print your name and date the form as well.

- Once all sections are completed, save the form with your changes. You can then download, print, or share the form as needed before submitting it to your employer for processing.

Complete the Hsa Payroll Deduction Form School District online today for a seamless payroll contribution experience.

Generally, HSA distributions used for qualifying medical expenses are not reported as income, thus not subject to tax. However, if the distribution is not used for qualifying expenses, it will need to be reported as income. Utilizing the HSA Payroll Deduction Form School District can help keep your records straight and ensure proper reporting.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.