Get 2012 Declaration Of Personal Property Short Form Groton Ct

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Declaration Of Personal Property Short Form Groton Ct online

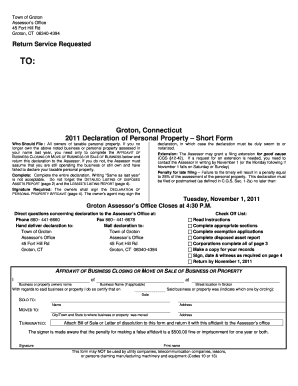

Filling out the 2012 Declaration Of Personal Property Short Form for Groton, Connecticut, can be a straightforward process when you know the correct steps to follow. This guide provides comprehensive instructions to help you complete the form accurately and efficiently online.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the declaration form and open it in your preferred editor.

- Begin by filling out your personal information, including your name, address, and business information if applicable. Ensure all details are accurate and clearly entered.

- Complete the taxable property information section by listing all personal property you own. Detailed descriptions with actual acquisition costs and depreciation values are required for each item.

- Fill out the Detailed Listing of Disposed Assets Report if applicable. This section is crucial if you have sold or disposed of any property mentioned in previous declarations.

- In the Affidavit section, sign and date the form. If an agent is completing on behalf of the owner, ensure the agent's statement includes the requisite authority.

- Double-check that all sections of the form are completed and all necessary documentation, such as exemption applications, are attached.

- Save changes to the filled form, and prepare to download, print, or share it. Be mindful of the deadline for submission to avoid penalties.

Complete your 2012 Declaration Of Personal Property Short Form online today to ensure compliance and avoid potential penalties.

Yes, Connecticut imposes a personal property tax on certain types of assets owned by individuals and businesses. This tax applies to items that you must declare through your 2012 Declaration Of Personal Property Short Form Groton CT. Filing your declaration accurately is key to understanding your tax obligations and ensuring you’re not overpaying. It’s beneficial to familiarize yourself with local tax rules to avoid surprises.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.