Loading

Get Sb# 550 Nj Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sb# 550 Nj Form online

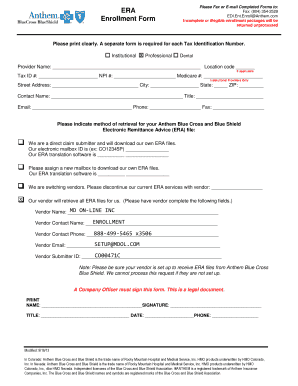

Filling out the Sb# 550 Nj Form online can streamline your enrollment process with MD On-Line. This guide will walk you through each section of the form, providing clear and detailed instructions to ensure your application is complete and accurate.

Follow the steps to complete the Sb# 550 Nj Form efficiently.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter your provider information at the top of the form, including your Provider Name and Tax ID number. Do not fill in the Location code or Medicare number.

- Select whether you are changing clearinghouses to MD On-Line. Ensure you do not modify any pre-completed submitter details in the middle section.

- Provide the name, title, email, and contact phone number of the authorized person who will sign this form.

- After completing the form, print it and have the authorized person sign and date it.

- Submit your signed form to MD On-Line’s enrollment team via fax or email, as indicated in the instructions.

- Ensure that any required fields for the Vendor section are completed, if applicable. This includes entering details for your vendor, if they will be retrieving the ERA files.

- Once your form is complete and submitted, keep a copy for your records and ensure you follow up if you do not receive confirmation of your submission.

Complete your Sb# 550 Nj Form online today to facilitate your enrollment process.

Yes, you typically need to file a NJ nonresident tax return if you earned income from New Jersey sources. This requirement ensures you report any state-sourced income on your SB# 550 NJ Form. Filing this return helps you determine your tax liability accurately. If you're unsure about your filing obligations, using resources from US Legal Forms can provide clarity and assistance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.