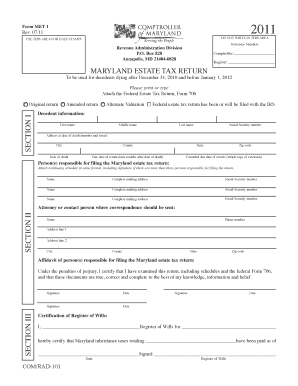

Get Met 3 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Met 3 Form online

Filling out the Met 3 Form online is a straightforward process that allows users to report and remit Maryland estate taxes efficiently. This guide will provide clear instructions on how to complete each section of the form, ensuring a smooth filing experience.

Follow the steps to fill out the Met 3 Form accurately.

- Press the ‘Get Form’ button to access the Met 3 Form and open it in your preferred online editor.

- Enter the decedent’s name and Social Security number in the designated fields. Ensure this information matches the records for accuracy.

- Provide the name of the county or Baltimore City where the Maryland estate tax return will be filed. This information is essential for directing the filing appropriately.

- Input the date of death of the decedent correctly, as this date is crucial for determining tax deadlines.

- Fill in the name and address of the contact person responsible for correspondence regarding the estate tax return. This should be someone who can provide additional information or clarify details if necessary.

- Specify the amount remitted for the estate tax. Double-check calculations to ensure the total matches the tax due amount.

- Review all entered information for accuracy before saving changes or submitting the form.

- Once completed, users can save changes, download a copy of the form, print it for records, or share it as required.

Complete and submit your Met 3 Form online to ensure timely processing of your estate tax obligations.

Filling out an AW 3 form involves providing necessary information about wage payments, tax withheld, and the identity of your business. Be thorough in verifying that all information is accurate, especially the taxpayer identification numbers. This form is crucial for reporting employee wages and ensuring proper tax documentation. Using US Legal Forms can help streamline your process in completing documents like the Met 3 Form and AW 3.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.