Loading

Get 2012 Fillable 1099a Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Fillable 1099a Form online

Completing the 2012 Fillable 1099a Form online can seem daunting, but this guide will help you understand each section and field of the form. By following these steps, you can efficiently fill out the form to meet your filing requirements.

Follow the steps to successfully complete the 2012 Fillable 1099a Form online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Identify the relevant information you need to enter, including details about the transaction and the borrower. Gather all necessary documentation to ensure accuracy.

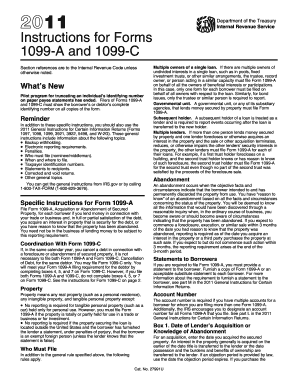

- Enter the date of the lender’s acquisition or knowledge of abandonment in Box 1. This is crucial as it indicates when the lender took possession of the property.

- In Box 2, provide the balance of the principal outstanding at the time of acquisition or when the property was deemed abandoned. Ensure that only unpaid principal is included.

- Box 3 is reserved; no entry is required here.

- Fill in Box 4 with the fair market value of the property at the time of foreclosure or abandonment. Use the appraised value or gross foreclosure bid price as appropriate.

- In Box 5, indicate whether the borrower was personally liable for repayment of the debt by marking the checkbox.

- Provide a description of the property in Box 6. For real property, include the address or specific identifiers. For personal property, specify the type, make, and model.

- Review all filled fields for accuracy. Ensure that the data is correct and complete before finalizing.

- Once all sections are completed, save your changes, and you can choose to download, print, or share the form as needed.

Start filling out your 2012 Fillable 1099a Form online now to ensure timely and accurate filing.

To file a corrected 1099-DIV, complete a new form with the correct information, noting that it is corrected. Use the 2012 Fillable 1099a Form to ensure it meets the IRS requirements. Remember to clearly indicate the corrections to avoid confusion. If you find this challenging, uslegalforms can help streamline the correction process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.