Loading

Get Vt Schedule In-153 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VT Schedule IN-153 online

Filling out the VT Schedule IN-153 is essential for determining your capital gains exclusion in Vermont. This guide provides a clear, step-by-step approach to help you complete the form accurately and efficiently online.

Follow the steps to complete the VT Schedule IN-153 online.

- Click ‘Get Form’ button to obtain the VT Schedule IN-153 form and open it in your preferred editor.

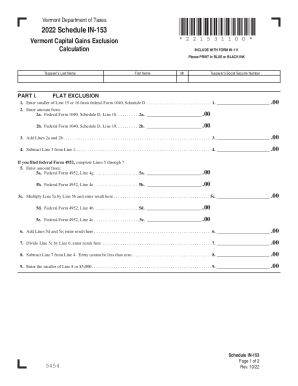

- Begin with Part I, where you will fill in the taxpayer’s last name, first name, middle initial, and social security number. Ensure that you use blue or black ink if you are printing it out.

- Complete Line 1 by entering the smaller amount of either Line 15 or Line 16 from your federal Form 1040, Schedule D.

- For Lines 2a and 2b, input the amounts from federal Form 1040, Schedule D, Lines 18 and 19, respectively.

- Proceed to Line 3 by adding the amounts from Lines 2a and 2b.

- Subtract Line 3 from Line 1 and enter the result on Line 4, ensuring it's a positive number.

- If you filed federal Form 4952, complete Lines 5 through 7 by gathering required information from that form.

- In Part II, only complete this section if you have eligible gains. Start by inputting data in Lines 10 through 17 as per the instructions given on the form.

- In Part III, enter the greater of Line 9 or Line 18 on Line 19, and complete Line 20 based on your calculation.

- Finally, enter the smaller of Line 19 or Line 20 on Line 21, concluding the completion of your Schedule IN-153.

- Review all fields for accuracy, then save your changes, download, print, or share the completed form as necessary.

Complete your VT Schedule IN-153 online today for accurate capital gains exclusion calculation.

Standard Deduction For tax year 2022, it is $13,050 for Married/CU Filing Jointly or Qualifying Widow(er), $6,500 for Single or Married/CU Filing Separately, $9,800 for Head of Household, and an additional $1,050 for individuals 65 and older and/or blind.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.