Loading

Get 1998 Instructions For 5500ez - Irs - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 1998 Instructions For 5500EZ - IRS - Irs online

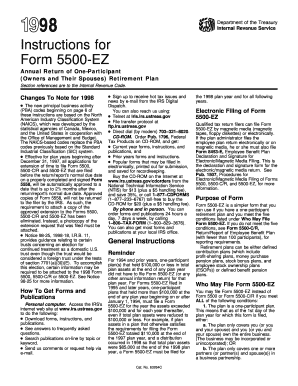

Filling out the 1998 Instructions for Form 5500-EZ can be a straightforward process when approached carefully. This guide offers clear, step-by-step instructions to help you complete the form online effectively.

Follow the steps to accurately complete the form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Read the general instructions carefully to understand the context of the form. Ensure you know whether you need to file Form 5500-EZ based on your plan's requirements.

- Fill in the top section of the form with required identifying information such as the employer's name and address, employer identification number (EIN), and plan name.

- Complete Line 2 to indicate if the employer is also the plan administrator, which will require a simple 'Yes' or 'No'. Provide additional details if the employer is not the administrator.

- For Lines 3 and 4, select the type of plan and complete any necessary additional measures regarding insurance contracts or master/prototype plans.

- Proceed to the financial section, filling out lines related to plan assets, contributions received, and distributions made, ensuring to adhere to the proper definitions provided in the instructions.

- Check the boxes for participation requirements and coverage to ensure compliance with coverage tests stated in the instructions.

- Verify if you need to attach any schedules or statements, such as Schedule B if applicable.

- In the final section, the plan administrator must sign and date the form to ensure its authenticity.

- Once all sections are complete and verified, save your changes, download the form to your device, print a physical copy if needed, or prepare it for sharing via the appropriate channels.

Complete your Form 5500-EZ filing online today to ensure compliance with IRS requirements.

Filing Form 5500-EZ involves gathering detailed information about your retirement plan and accurately completing the form. It's essential to follow the guidelines in the 1998 Instructions For 5500EZ - IRS - Irs to avoid mistakes. You can also use platforms like uslegalforms to assist in filing correctly and effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.