Loading

Get Bancorp Bank Hsa Transfer/rollover Request Form 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bancorp Bank HSA Transfer/Rollover Request Form online

Completing the Bancorp Bank HSA Transfer/Rollover Request Form online can simplify the process of moving your Health Savings Account funds. This guide will provide clear, step-by-step instructions to help you accurately fill out the form and ensure a smooth transfer or rollover.

Follow the steps to complete the HSA transfer/rollover request form.

- Press the ‘Get Form’ button to access the HSA Transfer/Rollover Request Form and open it in your preferred online editor.

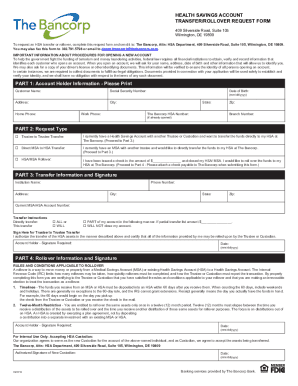

- Fill out Part 1: Account Holder Information by providing your full name, Social Security Number, address, city, home phone, work phone, date of birth, state, zip code, branch number, and Bancorp HSA number if already opened.

- In Part 2: Request Type, select the appropriate transfer option: 'Trustee to Trustee Transfer,' 'Direct MSA to HSA Transfer,' or 'HSA/MSA Rollover.' Ensure you follow any instructions related to the option you choose.

- Complete Part 3: Transfer Information and Signature. Enter the institution name, phone number, address, city, state, zip code, and current MSA/HSA account number. Specify whether you want to transfer all or part of your account and document the amount if you choose a partial transfer. Sign and date the form.

- If you selected HSA/MSA Rollover in Part 2, proceed to Part 4: Rollover Information and Signature. Acknowledge the rules and conditions applicable to the rollover, and provide your signature and date, ensuring the information is current and accurate.

- Review the completed form for any errors or omissions. Once confirmed, save your changes and choose to download, print, or share the form as needed.

Begin completing your Bancorp Bank HSA Transfer/Rollover Request Form online today to facilitate your account transfer.

Your HSA transfer and rollover amounts are not included in the current tax-year IRS contribution limits; however, if you made current tax-year contributions to your previous HSA, those contribution amounts will be included in your annual IRS contribution limit and reported to the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.