Loading

Get Form 10a100

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 10a100 online

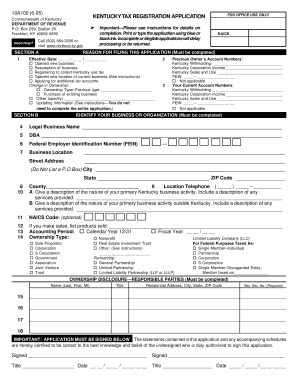

This guide provides a detailed overview of how to fill out the Form 10a100 online for Kentucky tax registration. Whether you are opening a new business or updating your existing information, this step-by-step approach will help you complete the form accurately.

Follow the steps to successfully complete the Form 10a100.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin with Section A: For office use only. Fill in the reason for filing, selecting from options such as opening a new business or resuming business activities.

- Specify the effective date for your application in the given format.

- Continue to Section B: Previous owner’s account numbers. If applicable, enter prior account numbers or mark 'not applicable'.

- Identify your business or organization. Complete fields for legal business name, DBA (Doing Business As), FEIN, address, and contact information.

- Provide a description of your primary business activity both inside and outside Kentucky. Optionally enter your NAICS code.

- In Section C: Tell us about your business or organization, indicate if you currently have or will hire employees in Kentucky.

- Answer additional questions regarding the nature of your business activities, such as sales and use tax obligations.

- Complete Section D for the employer's withholding account if applicable, including the number of employees and estimated withholding amounts.

- If you answered affirmatively to certain previous questions, proceed to Section E for the sales and use tax account details.

- Complete Section F if your business is subject to consumer's use tax.

- Finally, in Section G, input corporation income tax details if applicable, and provide a signature to certify the application is correct.

- Once all sections are completed, save changes, download the form, print it, or share the completed document as needed.

Start filling out your Form 10a100 online today to ensure your business complies with Kentucky tax regulations.

A U.S. W-8BEN form is a tax document that certifies you as a non-resident for tax purposes. It is essential when you receive income from U.S. sources, as it helps you avoid excessive tax withholding. To navigate your tax responsibilities effectively, consider utilizing resources like Form 10a100, which can assist you in managing your compliance needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.