Loading

Get Ncdor E 585

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ncdor E 585 online

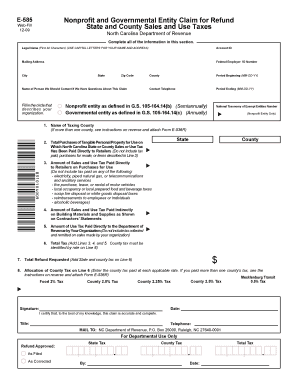

The Ncdor E 585 form is designated for nonprofit and governmental entities seeking a refund for state and county sales and use taxes. This guide will help you navigate through the online filling process efficiently and accurately.

Follow the steps to complete the Ncdor E 585 online effortlessly.

- Press the ‘Get Form’ button to access the Ncdor E 585 form and open it in your chosen online platform.

- Complete all required fields in the first section, including your legal name (using capital letters), account ID, mailing address, federal employer ID number, city, state, and zip code.

- Indicate the contact person for inquiries related to your claim, ensuring you provide their name and contact telephone number.

- Select the circle that describes your organization—whether a nonprofit entity or a governmental entity.

- Enter the period begin and end dates (MM-DD-YY) for the purchases related to the refund.

- If applicable, provide your National Taxonomy of Exempt Entities number.

- Fill in the name of the taxing county where tax was paid, or complete Form E-536R for multiple counties.

- Report the total purchases of tangible personal property for which state or county sales tax has been paid directly to retailers.

- Enter the amount of sales and use tax paid directly to retailers on purchases for use.

- Document the amount of sales and use tax paid indirectly on building materials and supplies as indicated on contractor statements.

- Record any use tax paid directly to the Department of Revenue by your organization.

- Calculate the total tax owed by adding the amounts from the previous lines.

- Determine the total refund amount requested by adding state and county taxes.

- Allocate county tax amounts based on applicable rates, ensuring all amounts match totals where necessary.

- Lastly, provide your signature, title, and date to certify the accuracy of the information provided.

- Save changes to the form, and use the available options to download, print, or share once completed.

Start filling out your Ncdor E 585 online today to ensure your refund request is processed smoothly.

Related links form

Yes, North Carolina provides various eFile forms, including the Ncdor E 585. These forms facilitate easier electronic filing, resulting in faster processing for your tax returns. Utilizing these forms can ensure that you meet all state requirements effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.