Loading

Get Vt Dot S-3 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VT DoT S-3 online

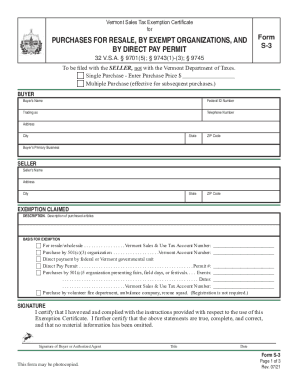

The Vermont Sales Tax Exemption Certificate, also known as Form S-3, is essential for exempt organizations and individuals purchasing goods for resale. This guide provides detailed, step-by-step instructions to help users navigate the process of completing the form online effectively.

Follow the steps to complete the VT DoT S-3 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- In the 'Buyer' section, fill in your name, federal ID number, trading name, telephone number, and complete address, including city, state, and ZIP code. Ensure accuracy in this information as it identifies you as the purchaser.

- Indicate whether this is a single purchase or a multiple purchase exemption. If selecting single purchase, enter the purchase price in the provided space.

- Complete the 'Seller' section by providing the seller's name and address, including city. This identifies the seller from whom you are purchasing.

- In the 'Exemption Claimed' section, describe the purchased articles clearly to establish what items are being exempted.

- Select an appropriate basis for exemption by checking the relevant box: resale, purchase by a 501(c)(3) organization, direct payment by a governmental unit, or direct pay permit. Be sure to include any necessary identification numbers or details, such as Vermont Sales & Use Tax Account numbers.

- If applicable, provide information for events or additional details when claiming exemption based on agricultural fairs or volunteer organizations.

- Sign and date the form in the designated 'Signature' section. If someone is signing on your behalf, include their title to clarify their authority.

- Review all entries for accuracy and completeness. Once finalized, save changes to your document, and proceed to download, print, or share the completed form as needed.

Complete your VT DoT S-3 online today for streamlined processing and compliance.

Most businesses operating in Vermont must first register with the Vermont Department of Taxes. For Sales and Use, Meals and Rooms, or Withholding you will need a separate business tax account for each of these respective taxes. Eligible exempt organizations must also register prior to using an exemption certificate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.