Get Form 3.00 - Imrf - Imrf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 3.00 - IMRF - Imrf online

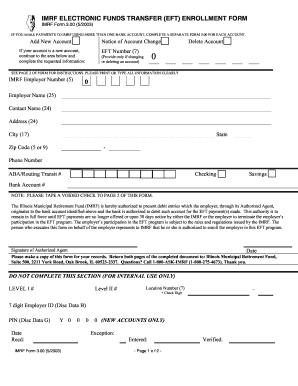

Filling out the Form 3.00 - IMRF - Imrf for electronic funds transfer is essential for employers who wish to enroll in this payment method or modify their existing enrollment. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete your Form 3.00 - IMRF - Imrf online.

- Click the ‘Get Form’ button to access the form and open it for editing.

- Choose the appropriate option for your needs: 'Add New Account', 'Notice of Account Change', or 'Delete Account'. Make sure to check the corresponding box.

- If you are adding a new account, fill in the 'EFT Number' field with the required 7-digit Employer Number.

- Complete the 'Employer Name' field using up to 25 characters as it should appear on financial documents.

- Provide the 'Contact Name' and complete the 'Address', 'City', 'State', and 'Zip Code' sections to provide your location details.

- Enter your 'Phone Number' for contact purposes.

- Fill in the 'ABA/Routing Transit #' with the 9-digit number that identifies your financial institution.

- Indicate whether the account type is 'Checking' or 'Savings' by selecting the appropriate option.

- Input your 'Bank Account #' which can be 1 to 17 digits and verify that it does not include the check number.

- Tape a voided check to page two of the form as indicated, ensuring no staples are used.

- Sign and date the form in the designated area on Page 1, confirming your authorization.

- After completing the form, make a copy for your records. Submit both pages to the Illinois Municipal Retirement Fund at the provided address.

Start filling out your forms online today to ensure timely processing!

Related links form

To be fully vested in the Illinois Municipal Retirement Fund (IMRF) program, you generally need to have at least 8 years of service credits. This means that after you accumulate 8 years of qualifying employment, you become entitled to receive retirement benefits. It's crucial to understand that meeting this requirement allows you to take full advantage of your IMRF benefits, detailed in Form 3.00 - IMRF - Imrf. With uslegalforms, you can easily navigate IMRF requirements and ensure your retirement planning is secure.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.