Loading

Get Irs 4562 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 4562 online

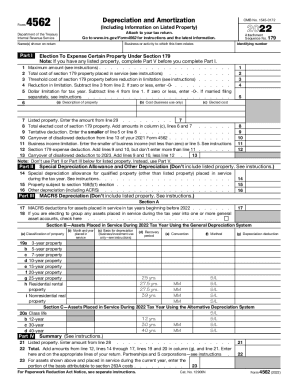

Filling out the IRS Form 4562 is an essential process for reporting depreciation and amortization of assets. This guide provides a clear step-by-step approach to help users navigate the form efficiently and accurately.

Follow the steps to complete your IRS 4562 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name(s) shown on your return and the identifying number in the appropriate fields at the top of the form.

- In Part I, provide details related to the section 179 property. First, enter the maximum amount allowed, followed by the total cost of the section 179 property placed in service.

- Follow with the threshold cost of the section 179 property before any reduction in limitation, and calculate the reduction by subtracting the threshold cost from the total cost.

- Next, determine the dollar limitation for the tax year by subtracting the reduction in limitation from the maximum amount.

- Proceed to detail each item of property in the provided zones, inputting descriptions and costs associated with business use.

- In Part II, if applicable, report the MACRS depreciation, beginning with 17 MACRS deductions for assets placed in service during previous tax years.

- For assets placed in service during the current tax year, accurately fill out the sections pertaining to the classification of property, placing in service dates, and recovery period.

- In Part III, summarize the listed property and ensure you report the total appropriately, directing to respective lines so that it reflects on your return correctly.

- Finally, review all sections, check for accuracy, and save any changes. You may then download, print, or share the completed form as necessary.

Complete your IRS 4562 online today for accurate reporting of depreciation and amortization.

Who needs to file Form 4562? You are only obligated to file Form 4562 if you're deducting a depreciable asset on your tax return. A depreciable asset is anything you buy for your business that you plan on using for more than one financial year. Generally, inventory doesn't count.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.