Get Official Form 113 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Official Form 113 online

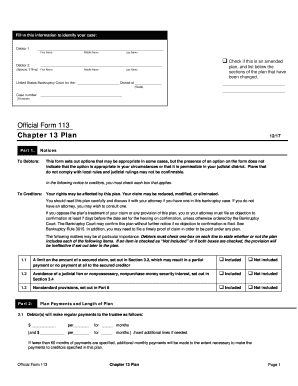

Filling out the Official Form 113 is an important step in Chapter 13 bankruptcy proceedings. This guide will provide clear, step-by-step instructions to assist users through the process of completing the form online, ensuring that all relevant information is accurately captured.

Follow the steps to successfully complete the Official Form 113 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the names of the debtors in the designated fields. You will need to input the first, middle, and last names for Debtor 1 and, if applicable, for Debtor 2 (or their partner).

- In the section labeled 'United States Bankruptcy Court for the:', select your applicable district from the drop-down menu and specify the state in the provided space.

- If this is an amended plan, check the box and list the sections of the plan that have been revised.

- Fill in your case number if known, in the appropriate field.

- Proceed to Part 1 and review the notices to debtors and creditors carefully. Ensure you understand that certain options may not be appropriate for your case.

- In Part 2, outline the proposed plan payments, specifying amounts and intervals. Clearly indicate how regular payments to the trustee will be made, checking all applicable payment methods provided.

- Section 2.3 prompts you to confirm your intentions regarding tax refunds. Choose one of the provided options as it relates to tax refunds during the plan's term.

- In Part 3, detail the treatment of secured claims by checking applicable boxes, providing information on creditors, collateral, and payment terms. Be detailed in keeping with your financial agreements.

- Continue with Parts 4 through 6 by addressing priority claims, unsecured claims, executory contracts, and any specific instructions relevant to your financial circumstances.

- Conclude by verifying that all pertinent sections are completed, then review the signature requirements in Part 9. Ensure all applicable signatures are provided before submitting the form.

- Once completed, you may save changes, download, print, or share the form as necessary.

Complete your Official Form 113 online today to progress with your Chapter 13 plan.

Yes, there are circumstances where you might not qualify for Chapter 13. These can include substantial debt that exceeds the limits, a prior dismissal of a case, or failure to receive credit counseling. It is advisable to assess your situation carefully and utilize the Official Form 113 to determine your eligibility. This approach allows you to identify any potential obstacles early on.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.