Loading

Get Irs Eic Reconsideration Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS EIC reconsideration form online

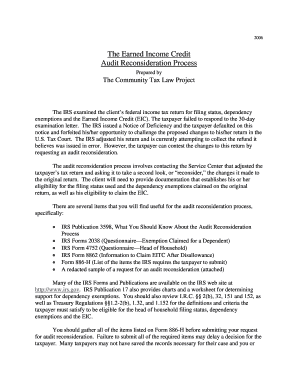

The IRS EIC reconsideration form serves as a crucial tool for individuals seeking to contest adjustments made to their Earned Income Credit claims. This guide provides clear, step-by-step instructions for completing the form online, ensuring that users can navigate the process effectively.

Follow the steps to complete the IRS EIC reconsideration form online.

- Click the ‘Get Form’ button to access the IRS EIC reconsideration form and open it in your document editor.

- Complete the identification section by entering your full name, social security number, and any relevant tax year information. Ensure that this information matches the records on your original tax filing.

- In the claim details section, describe the changes made to your tax return that you believe are in error. Provide clear explanations and reference any relevant IRS communications, like the Notice of Deficiency.

- Gather and attach supporting documentation that validates your eligibility for the Earned Income Credit and any dependency exemptions claimed. This may include wage statements, proof of residency, and documents certifying your child's relationship to you.

- Review the completed form for accuracy, ensuring that all fields are filled out and that the required documentation is attached. Double-check that your signature is included where necessary.

- Once verified, save your changes and choose an option to download, print, or share the completed form as needed before submission to the IRS.

Take action now by completing your IRS EIC reconsideration form online.

You can submit a correction by filing an amended tax return using Form 1040-X. Clearly indicate the corrections and the reasons for them. Ensure that any relevant details tied to the Irs Eic Reconsideration Form are included for clarity.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.