Loading

Get Mfut

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mfut online

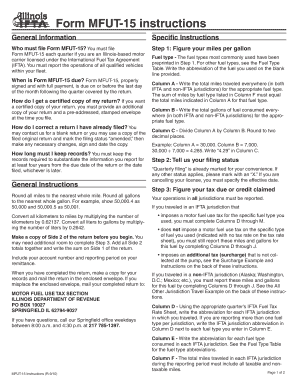

Filing the Mfut, specifically Form MFUT-15, is essential for Illinois-based motor carriers licensed under the International Fuel Tax Agreement. This guide provides a clear, step-by-step method to complete the form accurately and efficiently.

Follow the steps to successfully complete the Mfut online.

- Click ‘Get Form’ button to access the form and open it in your editor.

- Begin by calculating your miles per gallon. Gather total miles traveled and gallons of fuel consumed for the reporting period and record them accordingly.

- Indicate your filing status, which is pre-marked for quarterly filing. If applicable, mark other statuses and specify the effective date for cancellations.

- Figure your tax due or credit claimed. Complete columns as required based on your operations in both IFTA and non-IFTA jurisdictions. Make sure to report taxable and non-taxable miles accurately.

- Summarize your total tax due or any refund claimed by following the instructions laid out for lines and columns, ensuring you calculate correctly based on previous reports.

- After completing all sections, save your changes if possible. Then, you can proceed to download, print, or share your completed form as needed.

Complete your MFUT forms online today for accurate and timely filing.

The expense ratio for Mfut typically varies based on the specific plan you choose. It generally includes management fees and other costs associated with maintaining the fund. Understanding this ratio is crucial, as it affects your overall investment returns. To gain detailed insights on the expense ratio for Mfut, you can consult relevant financial resources or platforms that specialize in fund comparisons.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.